N.C. Insurance Commissioner Mike Causey has set a hearing date for a request to raise insurance rates for rental properties that could lead to an increase of more than 75 percent on new and renewing wind and hail policies for vacation and full time rental houses on the Outer Banks.

Causey said the department does not agree with the request by the North Carolina Rate Bureau, which represents insurers that write polices in the state.

The rate bureau submitted a filing in July that asks for a 50.6 percent statewide average rate increase for fire and extended coverage of dwelling policies, which are offered to non-owner-occupied residences of no more than four units, including rental properties, investment properties and other properties that are not occupied full time by the property owner.

Just nine months ago, the Rate Bureau was granted an increase by the state that averaged around 10 percent statewide on dwelling policies.

“The next step, according to statute, is to set a hearing date,” Causey said in a news release. “It is now necessary to hold a hearing to reach a resolution that will make the most financial sense for our residents and insurance companies.”

The hearing on the new request will take place April 8, 2024, at 10 a.m. in the Second Floor Hearing Room at the Department of Insurance, 3200 Beechleaf Court, Raleigh.

If the Department of Insurance and the N.C. Rate Bureau are able to negotiate a settlement before that date, the hearing would be canceled.

Under the filing released last month, fire policies would go up by a statewide average of 17 percent for buildings and 5 percent for contents.

Extended coverage for buildings and contents, which includes wind and hail policies, would be raised by a statewide average of 59.8 percent.

The last time the N.C. Rate Bureau made a dwelling rate filing was in August 2022, when it requested an average statewide increase of 42.6 percent.

The settlement announced in January calculated out to a statewide average increase of 9.9 percent, around $31, for new and renewing policies effective June 1.

While fire policy rates remained unchanged this year for some parts of northeastern North Carolina, extended coverage for buildings was raised by just over 12 percent and contents by between 11.5 and 13 percent.

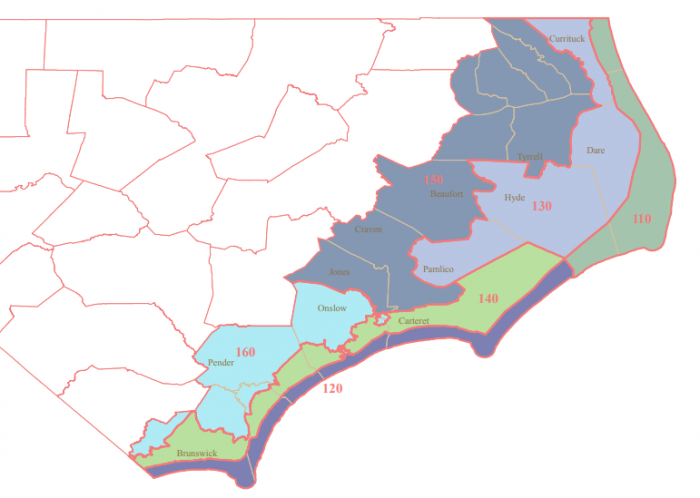

All areas east of the sounds from Carova Beach to Ocracoke as well as Roanoke Island are in Residential Insurance Territory 110. Currituck, Dare and Hyde mainland areas are in Territory 130. Camden, Pasquotank, Perquimans, Chowan, Tyrrell, and Washington counties are in Territory 150.

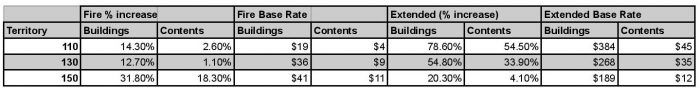

The request filed on July 13, with an effective date of June 1, 2024, for the territories of the Greater Outer Banks:

The requested increase on extended contents and buildings policies in Territory 150 is the lowest in the state.

The biggest hike proposed for extended coverage are Lenoir and Duplin counties (Territory 190) of 106 percent for buildings and 78.3 percent for contents.

Fire rates in Wake and Durham counties (Territory 270) would only experience a 3.3 percent rise for buildings, and a reduction of 7.3 percent for contents.

Hoke and Scotland counties (Territory 250) and Greene and Wayne counties (Territory 180) are the only other territories to receive a discount on their fire contents rates in the 2024 filing.

Wilson and Edgecombe counties, Territory 210, would be hit with the highest fire rate increases of 33.5 percent for buildings and 19.8 percent for contents.