The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn’t blame long term Insurance Australia Group Limited (ASX:IAG) shareholders for doubting their decision to hold, with the stock down 21% over a half decade.

It’s worthwhile assessing if the company’s economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let’s do just that.

Check out our latest analysis for Insurance Australia Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

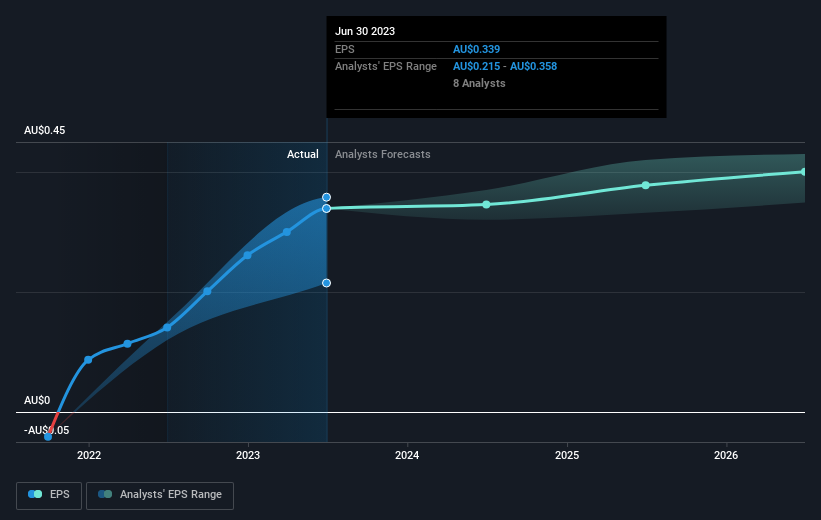

During the five years over which the share price declined, Insurance Australia Group’s earnings per share (EPS) dropped by 3.4% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 5% per year, over the period. This implies that the market is more cautious about the business these days.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Insurance Australia Group has improved its bottom line lately, but is it going to grow revenue? If you’re interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Insurance Australia Group, it has a TSR of -5.4% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It’s good to see that Insurance Australia Group has rewarded shareholders with a total shareholder return of 20% in the last twelve months. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 1.1% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. If you would like to research Insurance Australia Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.